Use It or Lose It – Exemptions Expire Soon

Sep 20, 2012 - Alerts by Hinkle Law Firm

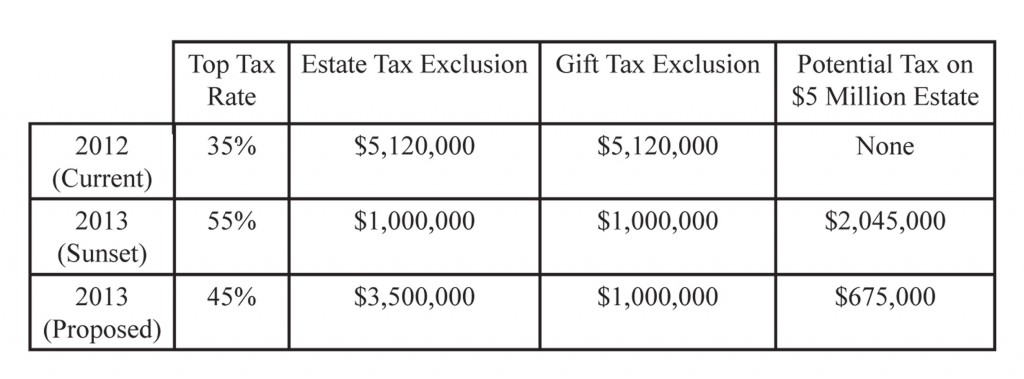

In December 2010, the federal gift and estate tax exemption was temporarily increased through 2012. As a result, a person can transfer up to $5.12 million without paying gift tax. A married couple can combine their exemption and transfer $10.24 million tax free. Unless Congress and the President agree before the end of the year, the federal gift and estate tax exemption will return to $1 million on January 1, 2013 (referred to as a “sunset”). The top tax rate will also increase substantially. The impact of these changes, as well as an alternative change in the rates and exemption proposed by the current administration, is illustrated in the following table:

Transferring property by lifetime gift may result in significant estate tax savings.

By using all or a portion of the current $5.12 million exemption now, rather than waiting to utilize the exemption in effect at your death, you are removing the asset and all appreciation on the transferred property from your taxable estate.

Making gifts to an irrevocable trust is just one of the tools available. We understand many clients are hesitant to make large gifts out of concern they will need access to the funds at a later date. We have developed techniques to alleviate these concerns. Each person and family has unique needs and goals. We believe every estate plan should be customized for each client. We are available to work with you now to take advantage of this opportunity before year-end.

If you have questions about this Alert, or for a comprehensive estate plan review, please call 316.631.3131.